Congress Members Urge Trump Administration to Apply Global Magnitsky Sanctions to Sudan

In a March 28, 2018 letter to the Deputy Secretary of State, a bipartisan group of 57 members of Congress expressed "grave concern," following the partial lifting in late 2017 of U.S. sanctions against the Sudan, "about any U.S. policy that…

Hdeel Abdelhady to Speak on Managing Money Laundering, Trade Sanctions, and Corruption Risks

House Bill Would Enhance U.S. States’ Iran Sanctions Authority

Congressional Hearing: Managing Terrorism Financing Risk in Remittances and Money Transfers

Sovereign Commercial Enterprises: Anti-Corruption and Confidentiality Risks

Dana Gas Says its Sukuk is Unlawful: Issues

Parsing Dana Gas’ Statement that Sukuk is “Unlawful”: Shari’ah, UAE Law, and Factual Questions [1] June 18, 2017 | Author: Hdeel Abdelhady* As discussed briefly in this June 16 MassPoint blog post, Dana Gas PJSC, the Sharjah, UAE-based gas producer, has unilaterally…

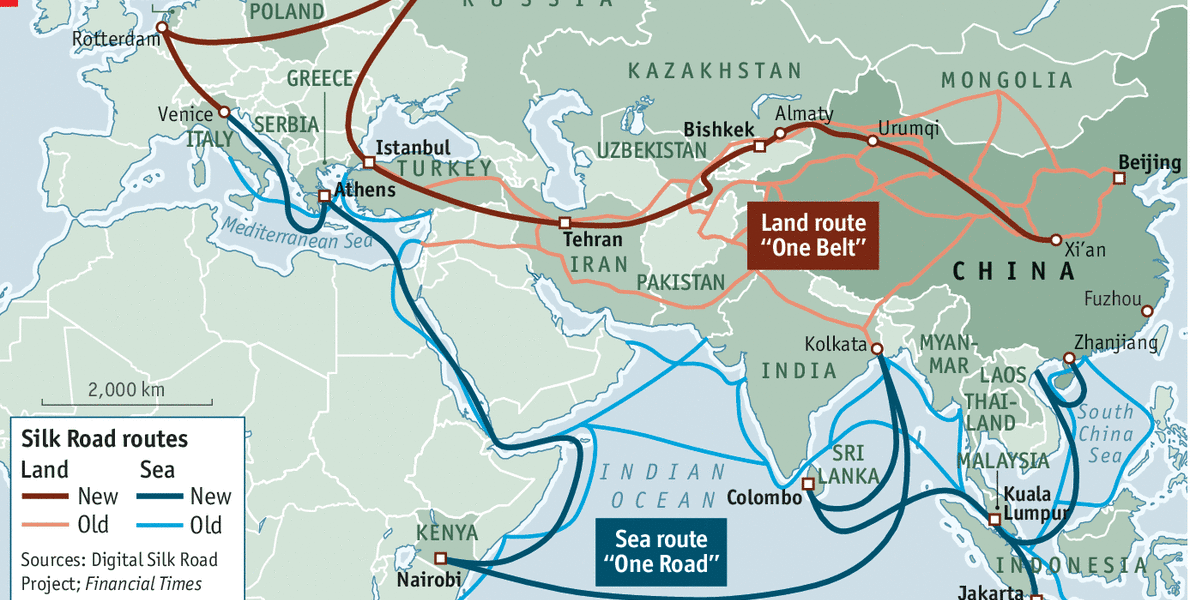

China’s One Belt One Road Could Disrupt U.S. Legal Dominance

Hdeel Abdelhady to Speak on Emerging Markets Social Impact Investment at NYU Law’s Grunin Center

Insolvency Regimes for Islamic Banks: Regulatory Prerogative and Process Design

Specialized Insolvency Regimes for Islamic Banks: Regulatory Prerogative and Process Design Author: Hdeel Abdelhady Original Publication: World Bank Legal Review, Volume 5 Abstract As Islamic banks grow in size and number, they will require enabling legal and regulatory environments to facilitate…